Alpacas As An Investment

Unless you pay to board your animals (called agistment) this is not a passive investment like CDs, bonds, or stocks. You are going to have to run this as a business if you want to make money from it.

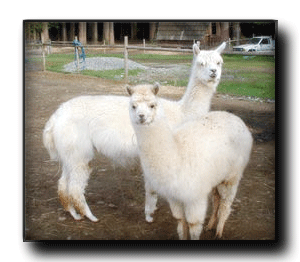

Not that this is difficult - most people find it a real pleasure to live and work with their alpacas. They are easy to manage, undemanding when it comes to their diet, and easy to train.

And unlike financially-based investments, you have the benefit of looking at them every day; watching them peacefully grazing and looking after their crias (baby alpacas).

Even if you choose to agist your herd, you can still get great financial benefits, as long as you spend a certain amount of time on your alpaca business.

Whether you are an active alpaca farmer or a passive investor, there are three main areas where you can benefit financially:

1. The alpacas can produce income in numerous ways: From the sale of livestock, alpaca products, services related to alpacas, consultancy...the list is endless. Many people delay the sale of their first alpacas for two or three years to allow time to build up their herd, taking advantage of the compounding effect of herd growth, but they can make an income by selling alpaca goods in the meantime.

2. There are significant tax benefits from owning alpacas. The first of these is the depreciation allowance that is granted for their purchase. But it doesn't end there - preparing the infrastructure of your farm (barns, fencing, equipment, etc.) will also be allowed against your tax bill.

3. The running expenses of your alpaca business will be allowed against your taxes every year. These will not only include feed bills, veterinary costs and other directly related costs, but can include trips to alpacas conferences and shows, research for the business, website costs, association memberships, a portion of your utility bills, and even the costs of employing family members. (Consult a qualified CPA for full details of your own circumstances.)

Raising alpacas can be an ideal lifestyle for people with children at home - they are often kept by people homeschooling, people who are retired but looking for a supplementary income, young couples wanting to start their own farm...in fact, they are ideal for people of all ages!

Everyone can get something different from farming alpacas: many people have them just as pets, or for their fiber. Not everyone wants to keep alpacas as an investment, but it is a great idea for those that do!

July 28, 2017